Construction companies seeking funding for equipment and projects have several financing options. Traditional loan applications require extensive documentation and collateral, while equipment leasing offers flexibility, lower initial costs, and tax benefits. A lender evaluation process considers financial health, project details, and equipment specifications to structure lease terms. This approach aligns with effective project management, allowing businesses to access cutting-edge technology without long-term ownership commitments, improving cash flow management.

“In the dynamic landscape of construction, securing the right funding is a cornerstone of successful projects. This article unveils comprehensive strategies for financing your construction equipment needs, offering valuable insights into the heart of effective project management. From exploring traditional banking loans and innovative equipment leasing to mastering the lender evaluation process, we guide you through every step.

Delve into case studies, uncover tax benefits, and learn how to seamlessly integrate financing into your project management plans. Whether you’re a seasoned contractor or just starting, these strategies will empower you to navigate the financial aspects of construction with confidence.”

- Understanding Your Financing Options

- – Overview of traditional banking loans and their requirements

- – Introduction to equipment leasing: benefits and processes

Understanding Your Financing Options

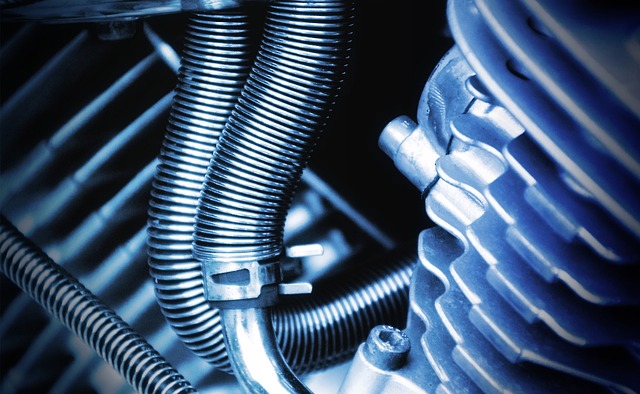

When it comes to funding your construction equipment needs, there’s a range of financing strategies available that cater to different business models and financial objectives. Understanding these options is key to making informed decisions that align with your project management approach. One popular choice is equipment leasing, which allows you to borrow the cost of machinery over a set period, offering tax benefits as lease payments are often deductible. This method can be advantageous for those seeking flexibility and wanting to preserve cash flow.

Another avenue is traditional loan applications through banks or credit unions. These institutions provide various loan types, including equipment financing loans, which are specifically tailored to fund the purchase of heavy machinery. A thorough lender evaluation process is essential here; comparing lenders based on interest rates, repayment terms, and any additional services they offer can help secure the best deal for your project. Effective project management often includes financial planning, and exploring these financing strategies ensures that you’re leveraging available resources to their fullest potential.

– Overview of traditional banking loans and their requirements

Traditional banking loans remain a common source of financing for construction projects and equipment acquisition. However, these loans come with stringent requirements that can be challenging for potential borrowers, especially small businesses or startups in the construction sector. Lenders typically demand comprehensive business plans, detailed financial projections, and collateral to secure the loan. This process often involves extensive paperwork and may take considerable time to approve, delaying project timelines.

When evaluating financing strategies, construction companies should consider equipment leasing as an alternative to traditional loans. Leasing offers flexibility in terms of term length and payment structures, aligning with the often-variable cash flow patterns of construction projects. Moreover, it can provide tax benefits by allowing businesses to deduct lease payments over time. Effective project management is facilitated through this approach, enabling companies to focus on core operations while maintaining access to necessary equipment without the long-term commitment of ownership.

– Introduction to equipment leasing: benefits and processes

Equipment leasing offers a flexible and strategic financing solution for construction businesses looking to acquire heavy machinery and vehicles. This alternative to traditional lending can provide numerous advantages, such as improved cash flow management, lower initial investment, and access to cutting-edge technology. The process typically involves a lender evaluating the borrower’s financial health, project details, and equipment specifications to determine lease terms. Once approved, a loan application is submitted, allowing businesses to secure the necessary funding for their construction projects.

One of the significant perks of equipment leasing is the potential tax benefits. Leased equipment often qualifies as an operating expense, reducing overall taxable income. This can be particularly beneficial for businesses aiming to optimize their tax strategy while ensuring they have the resources needed for efficient project management. By carefully considering equipment leasing as part of their financing strategies, construction companies can streamline their financial processes and stay competitive in a dynamic market.