Merchant Cash Advances (MCAs) offer a swift and appealing alternative to traditional loans, providing immediate financial support with simplified eligibility criteria based on credit card sales volume. Ideal for startups or SMEs lacking extensive credit history, MCAs feature flexible repayment structures aligned with daily sales, easing cash flow management. While best suited for short-term needs, they carry higher interest rates than conventional loans and should be carefully assessed. Key benefits include quick capital access, flexible terms, and no hidden fees, making MCAs a game-changer for businesses needing immediate financial relief without long-term debt obligations.

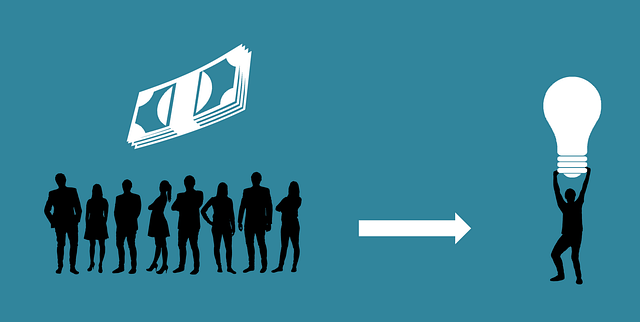

In today’s dynamic business landscape, swift and flexible funding is crucial for growth. Discover how a Merchant Cash Advance (MCA) offers a revolutionary fast business funding solution with unique benefits. MCAs provide quick capital access, enabling entrepreneurs to seize opportunities. With flexible repayment options tailored to your revenue stream, higher cost financing becomes manageable. This article explores why short-term business solutions like MCAs are essential, compares them to traditional loans, and provides strategies for effectively managing this powerful financial tool.

- Understanding Merchant Cash Advance Benefits: A Fast Business Funding Solution

- How Fast Capital Access Can Boost Your Business

- Flexible Repayment Options: The Key to Navigating Higher Cost Financing

- When Is a Short-Term Business Solution Necessary?

- Comparing Traditional Loans vs. Merchant Cash Advances

- Strategies for Effective Management: Higher Cost Financing Made Manageable

Understanding Merchant Cash Advance Benefits: A Fast Business Funding Solution

Merchant Cash Advance (MCA) offers a unique and attractive benefit as a fast business funding solution. Unlike traditional loans that often come with stringent requirements and lengthy approval processes, MCAs provide quick capital access to businesses in need of immediate financial support. This is particularly advantageous for small and medium-sized enterprises (SMEs) or startups with limited credit history or cash flow records, as it simplifies the borrowing process significantly.

One of the key advantages of MCAs is their flexible repayment options. Instead of fixed monthly installments, business owners can structure repayments based on a percentage of their daily sales, making it easier to manage cash flow. This higher cost financing approach may be suitable for short-term business solutions where rapid funding is required to cover immediate expenses or capitalize on market opportunities. However, businesses should carefully consider the overall cost, as MCAs typically have higher interest rates compared to conventional loans.

How Fast Capital Access Can Boost Your Business

Having quick access to capital is a significant advantage for any business, especially in today’s fast-paced market. A merchant cash advance (MCA) offers one of the fastest ways to secure funding with minimal hassle and flexible repayment terms. This alternative financing option is particularly appealing to small businesses and startups that may struggle to qualify for traditional loans from banks.

The benefits of MCAs as a short-term business solution are numerous. They provide fast business funding, allowing entrepreneurs to seize opportunities or overcome immediate financial challenges swiftly. Unlike higher cost financing options, MCAs have relatively simple eligibility criteria, often just requiring steady sales volume through credit card transactions. This makes them accessible to a broader range of businesses, providing an excellent short-term solution until more conventional funding sources become available.

Flexible Repayment Options: The Key to Navigating Higher Cost Financing

In today’s fast-paced business landscape, having quick capital access is crucial for navigating unexpected expenses or seizing growth opportunities. One popular short-term business solution that offers both speed and flexibility is a merchant cash advance (MCA). Unlike traditional loans with rigid repayment structures, MCAs provide businesses with flexible repayment options tailored to their unique sales patterns. This means merchants can align their payments with peak revenue periods, easing the financial burden during slower times.

The merchant cash advance benefits extend beyond this flexibility. It offers a straightforward application process, often without the need for extensive documentation or credit checks. This agility allows businesses to secure funding promptly, addressing immediate financial needs. Moreover, MCAs typically involve no hidden fees or complicated terms, making them an attractive option for those seeking transparent higher cost financing.

When Is a Short-Term Business Solution Necessary?

In today’s dynamic business landscape, having access to fast capital can be a game-changer for entrepreneurs and small business owners. A short-term business solution like a merchant cash advance (MCA) offers numerous benefits, especially when quick capital access is crucial. MCAs provide an alternative to traditional loans, catering to businesses that may not have the time or credit history to qualify for bank financing. This rapid funding method is particularly appealing for those in need of flexible repayment options, as it typically aligns with a business’s cash flow cycle, allowing for more manageable payments.

Whether it’s unexpected expenses, inventory purchases, or seizing market opportunities, short-term funding can be a lifesaver. Unlike higher cost financing with lengthy terms, MCAs offer simplicity and speed. They are ideal for businesses seeking to avoid complex application processes and lengthy approval times. With quick capital on hand, business owners can navigate challenges promptly, ensuring smooth operations and potentially opening doors to new growth opportunities.

Comparing Traditional Loans vs. Merchant Cash Advances

When businesses need fast capital, they often find themselves at a crossroads between traditional loans and merchant cash advances (MCAs). While both offer quick funding solutions, MCAs stand out for their distinct advantages in the realm of fast business funding. One of the primary benefits of MCAs is their flexible repayment options. Unlike traditional loans that adhere to strict monthly payments, MCAs typically involve daily or weekly repayments linked directly to your sales volume. This aligns perfectly with the cash flow patterns of many businesses, allowing them to manage their finances more effectively.

Moreover, quick capital access is a significant advantage of MCAs over higher cost financing methods. Traditional loans often come with lengthy application processes and stringent eligibility criteria, which can delay funding. In contrast, MCAs provide a straightforward and swift approval process, often within days, enabling businesses to secure the funds they need promptly. This makes MCAs an attractive short-term business solution for companies seeking immediate financial support without the constraints of traditional loan terms.

Strategies for Effective Management: Higher Cost Financing Made Manageable

In today’s fast-paced business landscape, access to quick capital is crucial for navigating unexpected expenses and seizing growth opportunities. One strategy gaining traction among entrepreneurs is leveraging merchant cash advances (MCA), a unique form of short-term business funding. MCAs offer significant advantages, particularly for businesses dealing with higher cost financing requirements. Unlike traditional loans, these advances provide fast business funding without the need for collateral or complex credit checks. This makes them an attractive option for companies seeking flexible repayment options and quick capital access.

With a merchant cash advance, businesses receive a lump sum to cover immediate financial needs, and repayment is structured as a percentage of future sales. This model aligns perfectly with the unpredictable nature of many industries, allowing entrepreneurs to manage cash flow more effectively. Moreover, MCAs cater to various business types, from retail stores to service-based enterprises, ensuring that flexible repayment terms can be tailored to meet individual needs. This approach not only eases financial pressure but also enables businesses to focus on growth and expansion without the burden of long-term debt obligations.