purchase order (PO) financing empowers small and medium-sized enterprises (SMEs) by transforming outstanding POs into immediate working capital, providing a flexible solution to cash flow challenges. Its key benefits include stabilized cash flow, reduced financial risks, improved supplier relationships, enhanced operational flexibility, and competitive advantages in the market. PO financing supports business growth through expansion, new products, and seasonal fluctuations, making it a powerful tool for long-term success and stability. By unlocking future sales with minimal upfront costs, PO financing offers SMEs a game-changing solution to manage operations, invest, and navigate market opportunities effectively.

“Struggling with cash flow issues? Explore the power of Purchase Order (PO) financing as a strategic tool to stabilize and enhance your business’s financial health. This comprehensive guide delves into the world of PO financing, offering insights on its numerous advantages, especially for small businesses. From understanding the basics to unlocking cash flow potential, we’ll explore how this innovative approach can drive growth, streamline operations, and provide much-needed capital. Discover the benefits, strategies, and value of PO financing, a game-changer for business stability.”

- Understanding Purchase Order (PO) Financing: A Comprehensive Guide

- The Benefits of PO Financing for Business Growth and Stability

- Unlocking Cash Flow: How PO Financing Works and Its Advantages

- PO Financing for Small Businesses: Streamlining Operations and Funding

- Measuring Success: Evaluating the Value and Perks of Purchase Order Financing

- Strategies for Utilizing PO Financing to Enhance Financial Health

Understanding Purchase Order (PO) Financing: A Comprehensive Guide

Purchase Order (PO) financing is a powerful tool that offers numerous advantages and benefits to businesses, especially small enterprises navigating cash flow challenges. By understanding this financing mechanism, companies can unlock valuable opportunities for growth and stability. PO financing essentially involves securing funds against outstanding POs with suppliers, providing businesses with immediate liquidity. This method streamlines the payment process, allowing firms to maintain a consistent supply chain without the usual cash outlay.

One of the key benefits is improved cash flow management. It provides small businesses with the means to bridge the gap between purchasing goods or services and receiving payments from customers. PO financing also reduces financial risks by ensuring timely supplier payments, fostering strong vendor relationships. Additionally, it offers a flexible funding solution tailored to each business’s unique needs, providing a competitive edge in today’s fast-paced market.

The Benefits of PO Financing for Business Growth and Stability

Purchase order (PO) financing offers a host of advantages that can significantly boost business growth and stability, especially for small and medium-sized enterprises (SMEs). One of its key benefits is providing access to immediate working capital, enabling businesses to fund their operations without the delay associated with traditional financing methods. By utilizing PO financing, companies can meet their short-term financial needs, such as purchasing inventory, paying suppliers, or covering operational expenses, thereby stabilizing cash flow and ensuring business continuity.

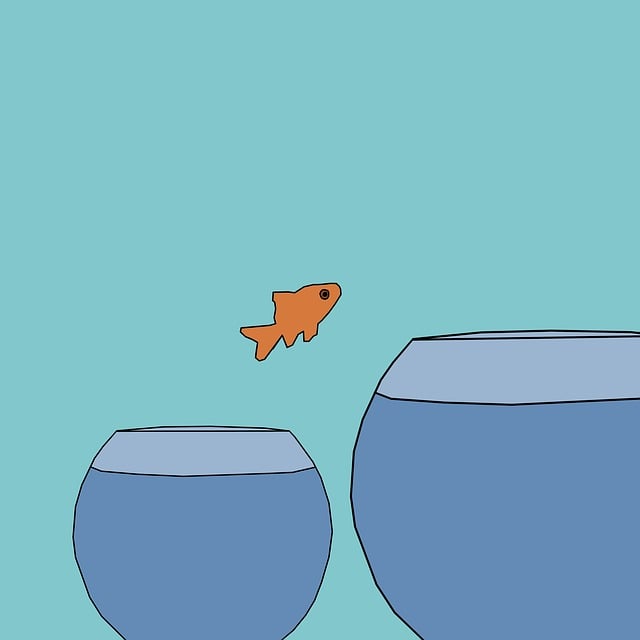

Furthermore, PO financing is a flexible solution tailored to the unique requirements of each business. It allows companies to avoid high-interest rates often associated with short-term loans and provides a simple and efficient way to access funds. This financing method also reduces financial risk for both buyer and supplier, as it shifts payment obligations from the buyer to the seller’s terms, fostering a collaborative relationship. For small businesses in particular, PO financing can be a game-changer, offering valuable support for expansion, new product launches, or navigating seasonal fluctuations, ultimately contributing to long-term success and stability.

Unlocking Cash Flow: How PO Financing Works and Its Advantages

Purchase Order (PO) financing is a game-changer for small businesses seeking to stabilize their cash flow. This innovative funding method allows businesses to access working capital by financing their outstanding POs with suppliers. Instead of waiting for payment from customers, businesses can receive funds as soon as the goods or services are delivered and accepted, accelerating cash inflows significantly.

The advantages of PO financing are numerous. It offers a straightforward and efficient solution to the common challenge of cash flow management, especially for companies with seasonal fluctuations or uneven customer payment cycles. By leveraging existing purchase orders, businesses can unlock immediate financial support without incurring additional debt or compromising their creditworthiness. This funding method also provides flexibility, allowing businesses to focus on core operations while maintaining a healthy cash position. Additionally, PO financing can open doors to exclusive supplier terms and discounts, further enhancing its value for small businesses aiming to optimize their financial position and gain competitive advantages in the market.

PO Financing for Small Businesses: Streamlining Operations and Funding

Small businesses often face cash flow challenges due to delayed payments from customers. This is where Purchase Order (PO) financing comes into play, offering a powerful solution to streamline operations and secure funding. By utilizing PO financing, small businesses can access working capital before the sale is finalized, providing them with the financial flexibility they need to manage day-to-day expenses and growth opportunities.

The benefits of PO financing are manifold. It allows businesses to convert their accounts receivable into immediate cash, improving cash flow management and enabling them to invest in inventory, equipment, or expansion. This financing method is particularly advantageous for small businesses as it provides access to capital without the need for collateral, reducing financial risk. Additionally, PO financing can help businesses negotiate better terms with suppliers, gain pricing advantages, and establish stronger relationships, ultimately contributing to long-term success and stability.

Measuring Success: Evaluating the Value and Perks of Purchase Order Financing

Measuring Success: Evaluating the Value and Perks of Purchase Order Financing

The success of purchase order (PO) financing is often gauged by its ability to stabilize cash flow for small businesses. By providing upfront funding against outstanding POs, PO financing offers a range of benefits that can significantly enhance operational efficiency and growth prospects. One of the key advantages is improved liquidity, allowing businesses to meet immediate financial obligations without straining their resources. This enables them to focus on core activities, such as expanding operations, investing in inventory, or pursuing strategic initiatives.

PO financing also offers several perks that contribute to long-term success. It can help build stronger supplier relationships by demonstrating a company’s financial stability and commitment to timely payments. Furthermore, it streamlines the accounts payable process, reducing administrative burdens and enhancing cash flow management. Ultimately, PO financing provides small businesses with a flexible funding solution that not only addresses immediate cash flow needs but also paves the way for sustained growth and profitability.

Strategies for Utilizing PO Financing to Enhance Financial Health

Purchase order (PO) financing is a strategic tool that can significantly enhance the financial health of small businesses. By utilizing this method, companies can unlock several advantages and reap substantial benefits. One of the key perks is improved cash flow management, allowing businesses to stabilize their financial position by accessing funds tied to outstanding POs. This strategy enables them to meet immediate financial obligations and seize growth opportunities without the delay associated with traditional financing methods.

Moreover, PO financing offers a flexible funding solution tailored to the needs of small businesses. It provides an alternative to conventional loans, especially for companies with limited credit history or assets. The process involves factoring outstanding POs into immediate cash flow, offering a quick infusion of capital. This approach not only helps in managing day-to-day operations but also empowers businesses to invest in inventory, expand their reach, or take advantage of market trends, ultimately driving growth and increasing profitability.