Complex probate cases require specialized legal expertise for managing intricate asset distribution among multiple beneficiaries. Estate distribution experts use strategic planning and knowledge of legal precedents to resolve disputes, value assets, and ensure fairness according to the testator's wishes while adhering to tax regulations and legal obligations. Key strategies include mediation, open communication, estate planning, and careful execution to simplify processes and maximize beneficiary proceeds.

Probate law can be a complex labyrinth, especially when dealing with intricate estate matters. This comprehensive guide aims to demystify the process, offering insights into resolving diverse probate challenges. From understanding complex cases and navigating estate distribution to utilizing legal strategies for uncontested estates, we explore effective approaches. Learn how dispute resolution techniques, tax considerations, and ensuring will execution fairness contribute to a seamless transition of assets.

- Understanding Complex Probate Cases

- Navigating Estate Distribution Challenges

- Legal Strategies for Uncontested Estates

- Dispute Resolution: Mediation & Litigation

- Tax Implications on Estate Transfer

- Ensuring Fairness in Will Execution

Understanding Complex Probate Cases

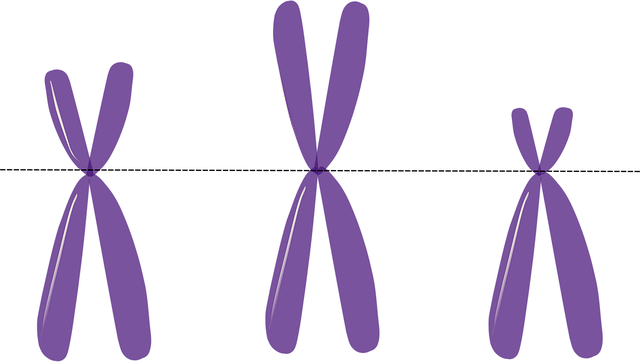

Complex probate cases often involve intricate financial and legal situations, making them significantly more challenging than straightforward wills. These matters may include disputes over will validity, contested estates, or complex asset distribution. Understanding the nuances of each case is paramount for effective resolution. Estate distribution becomes a delicate process when multiple beneficiaries, unknown assets, or contested claims are involved.

Professional judgment and legal expertise are crucial in navigating these complexities. Attorneys specializing in probate law must thoroughly examine evidence, interpret legal documents, and often mediate or litigate disputes among family members or interested parties. The goal is to ensure that the final estate distribution reflects the testator’s intentions while adhering to legal requirements.

Navigating Estate Distribution Challenges

Probate legal matters can often involve intricate estate distribution challenges, especially in cases with complex assets and multiple beneficiaries. When a will is contested or unclear, determining the rightful distribution becomes a delicate process. This may include resolving disputes over property ownership, valuing intangible assets like intellectual property, or managing conflicts between family members regarding inheritance preferences.

Estate distribution experts must carefully consider legal precedents, state laws, and the specific circumstances of each case. They employ strategic planning and negotiation techniques to navigate these challenges, ensuring a fair and just resolution for all parties involved. By leveraging their knowledge and experience, they can help families move forward during an emotionally charged time, fostering understanding and agreement regarding the division of assets.

Legal Strategies for Uncontested Estates

In many cases, legal strategies can make the process of resolving an uncontested estate smoother and more efficient. When there’s no dispute over the will or estate distribution, these strategies become instrumental in streamlining probate proceedings. One common approach is to prepare a detailed inventory of the estate assets, ensuring transparency and simplifying the valuation process. This step is crucial for accurately determining the value of the estate, which is essential for proper tax planning and final distribution among beneficiaries.

Additionally, engaging in open communication with all parties involved can prevent potential conflicts. Beneficiaries should be made aware of their rights and the overall probate process to ensure they understand their expectations. This proactive approach fosters a collaborative environment, allowing for swift decision-making and the timely transfer of assets as per the deceased’s wishes, focusing primarily on estate distribution.

Dispute Resolution: Mediation & Litigation

When it comes to resolving complex probate legal matters, dispute resolution is a critical component. Mediation and litigation are two primary approaches that can be employed depending on the nature of the dispute and the preferences of the parties involved. Mediation offers a more collaborative and cost-effective alternative where a neutral third party facilitates negotiations between all stakeholders. This process encourages open communication and mutual understanding, aiming to reach an agreement that satisfies everyone without the need for lengthy court battles.

On the other hand, litigation involves formal legal proceedings in which each side presents its case before a judge or jury. While it can be a more aggressive approach, it may also be necessary when disagreements persist despite good-faith efforts to mediate. In such cases, the court will make a binding decision on all issues, including estate distribution, ensuring a resolution but potentially at a higher cost and with more delay than mediation.

Tax Implications on Estate Transfer

When resolving complex probate legal matters, understanding the tax implications on estate transfer is paramount. The distribution of an estate can significantly impact various tax liabilities, including inheritance tax, estate tax, and gift tax. These taxes are often levied based on the total value of the transferred assets, with rates varying depending on the jurisdiction and relationship between the decedent and beneficiary. For instance, in some jurisdictions, certain exemptions or reduced rates apply to close family members, while non-family transfers may incur higher taxes.

Estate planning strategies can mitigate these tax burdens by utilizing tools like trusts, gift giving, and careful timing of transfers. Tax-efficient estate distribution ensures that more assets reach the intended beneficiaries, aligning with the decedent’s wishes while minimizing financial obligations for the family. This careful navigation through tax laws is crucial in preserving the estate’s value and ensuring a smoother transition during probate.

Ensuring Fairness in Will Execution

Ensuring fairness in the execution of a will is paramount, especially in complex probate cases where numerous beneficiaries and intricate asset distributions are involved. The primary objective is to uphold the testator’s intentions while maintaining transparency and equity for all parties. This necessitates meticulous planning and adherence to legal procedures.

A fair will execution involves clear and specific instructions regarding estate distribution, minimizing ambiguity that could lead to disputes. It also entails appointing competent executors who understand their roles in managing assets, following legal guidelines, and acting in the best interests of beneficiaries. Regular communication and updates during the probate process can foster trust, ensuring all involved are aware of progress and any changes in the intended estate distribution.