The Oregon probate process involves a personal representative initiating court-validated will distribution, asset inventorying, debt/tax payment, and property allocation according to the will or state laws. It requires understanding court procedures, document filing, and timeframes for non-lawyers to ensure fair, legal estate management.

Oregon’s probate process can seem complex for nonlawyers, but understanding these key steps is essential. This guide breaks down the basics of Oregon probate, including property distribution and navigating court involvement. By understanding these crucial aspects, you’ll be better equipped to manage estate affairs efficiently. From initial filing procedures to timeframes and court requirements, this overview simplifies the process, ensuring peace of mind during a challenging time.

- Understanding Oregon Probate Basics

- Property Distribution in Probate

- Navigating Court Involvement & Timeframes

Understanding Oregon Probate Basics

Understanding Oregon Probate Basics

The Oregon probate process is a series of legal procedures designed to facilitate the distribution of a deceased person’s assets and manage their estate according to state laws. It begins with the filing of a petition for probate by a designated personal representative, often a close family member or trusted individual named in the will. This initial step is crucial as it allows the court to officially recognize and validate the will, ensuring its validity and authority.

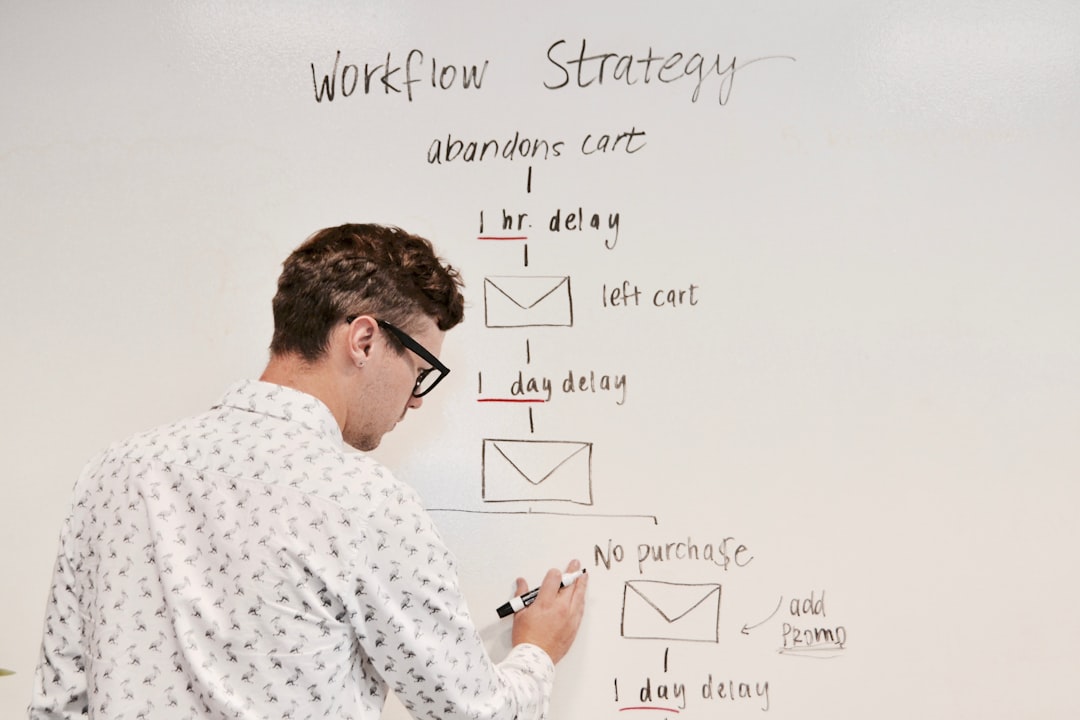

Once the petition is filed, the court appoints the personal representative, who becomes responsible for managing the estate. They are tasked with identifying and valuing all assets, paying outstanding debts and taxes, and distributing the remaining property as outlined in the will or, if there is no will, according to Oregon’s default inheritance laws. The entire process involves several steps, including court hearings, filing required documents, and adhering to specific time frames, ensuring a structured and lawful transition of the deceased individual’s affairs.

Property Distribution in Probate

In the Oregon probate process, one of the core aspects is property distribution—a meticulous procedure that ensures the equitable division of a deceased individual’s assets according to their will or state laws if they died intestate. This process begins with identifying and valuing all assets, both real and personal. Personal assets include financial accounts, investments, and tangible possessions, while real assets encompass properties and land.

Oregon probate courts facilitate this distribution by overseeing the administration of the estate. They appoint an executor (or personal representative) to manage the estate’s affairs, including collecting debts, paying taxes, and selling assets if necessary. Upon completion of these tasks and after satisfying any outstanding obligations, the court distributes the remaining assets as directed by the will or determined by Oregon’s intestate succession laws. This ensures a fair process, giving effect to the deceased person’s wishes while adhering to legal requirements.

Navigating Court Involvement & Timeframes

Navigating court involvement and timelines is a crucial aspect of the Oregon probate process for nonlawyers. If the value of the estate exceeds certain thresholds, or if there are disputes among beneficiaries, legal assistance becomes necessary. The first step is typically filing a petition with the local probate court, which initiates the official proceedings. This involves gathering essential documents, such as death certificates, wills, and financial statements, to provide a clear picture of the decedent’s assets and liabilities.

Timeframes play a significant role in the Oregon probate process. After the petition is filed, there are deadlines for responding parties, with each step having its own timeline. This includes notice periods for beneficiaries, time for the personal representative (PR) to identify and locate assets, and potential delays due to court holidays or backlogs. Understanding these timelines is vital to ensure the efficient administration of the estate and to avoid unnecessary complications.