Online checks offer convenience but face security risks like fraud and identity theft, cost structures with hidden fees, technical glitches causing delays, accessibility issues for rural or digital-unfamiliar users, and impersonal experiences. Despite these drawbacks, they provide speed, efficiency, and real-time tracking, requiring balanced consideration of technology's benefits versus potential disruptions.

In the digital age, online checks have emerged as a convenient alternative to traditional paper checks. However, understanding their availability, security, costs, and efficiency is crucial before adopting them. This article delves into the comparison between online and traditional checks, exploring key aspects such as convenience, security concerns, cost-effectiveness, time savings, and potential drawbacks of online checks for businesses. By examining these factors, individuals and organizations can make informed decisions regarding their payment methods.

- Convenience and Accessibility of Online Checks

- Security Concerns With Digital Transactions

- Cost Comparisons Between Online and Traditional Checks

- Time Efficiency: Online vs. Paper Checks

- Drawbacks of Online Checks for Businesses

- The Role of Technology in Check Processing

Convenience and Accessibility of Online Checks

The convenience and accessibility of online checks are undeniable, offering a swift and seemingly effortless alternative to traditional paper checks. With just a few clicks, individuals can now transfer funds, pay bills, or deposit cheques from the comfort of their homes. This digital approach has democratized financial transactions, allowing even those in remote areas with limited access to banks to participate in the modern economy.

However, despite these advantages, there are drawbacks to online checks. Security concerns, such as fraud and identity theft, are prominent, as sensitive financial information is exchanged electronically. Moreover, internet connectivity issues or technical glitches can disrupt the process, causing delays and potential frustration for users. These challenges highlight the importance of robust security measures and reliable technology in ensuring a seamless experience with online checks while mitigating associated risks.

Security Concerns With Digital Transactions

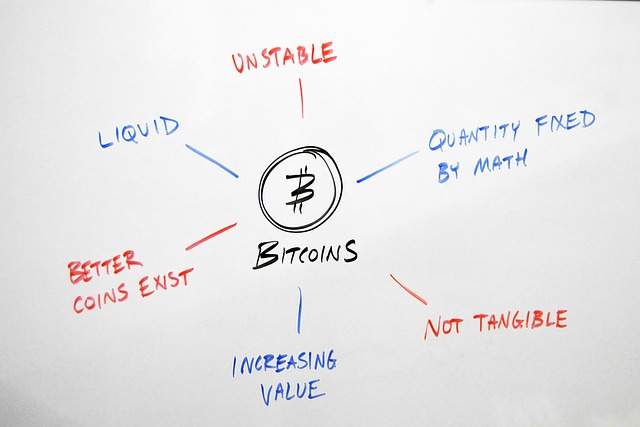

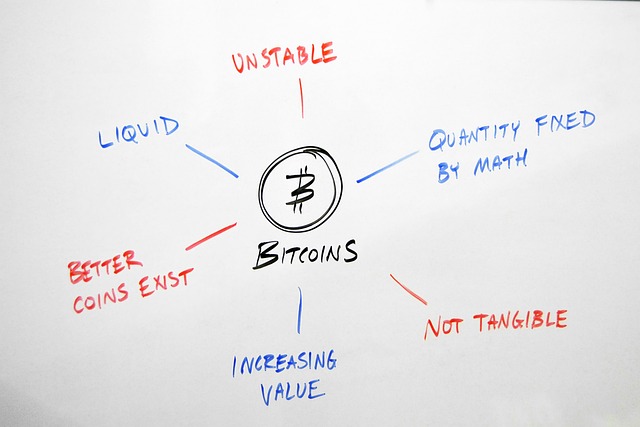

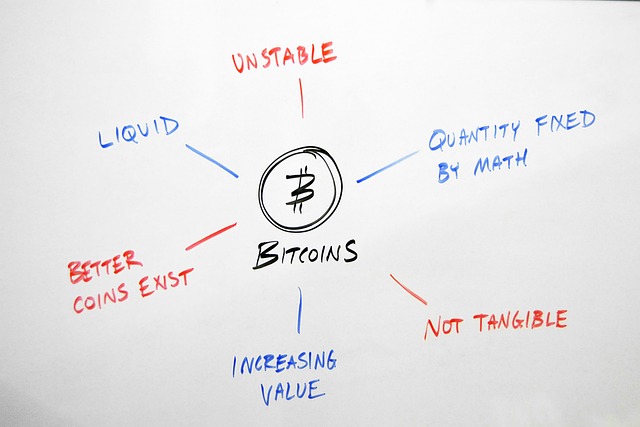

While digital transactions offer immense convenience, there are genuine security concerns that come with them, particularly when compared to traditional checks. The primary drawback lies in the increased risk of fraud and identity theft. Online platforms can be vulnerable to cyberattacks, where hackers gain unauthorized access to sensitive financial data stored on databases. This exposes personal information, including account numbers and transaction histories, which can then be used for malicious purposes.

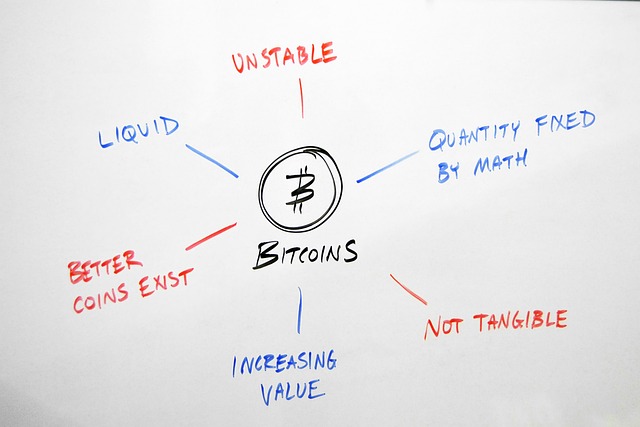

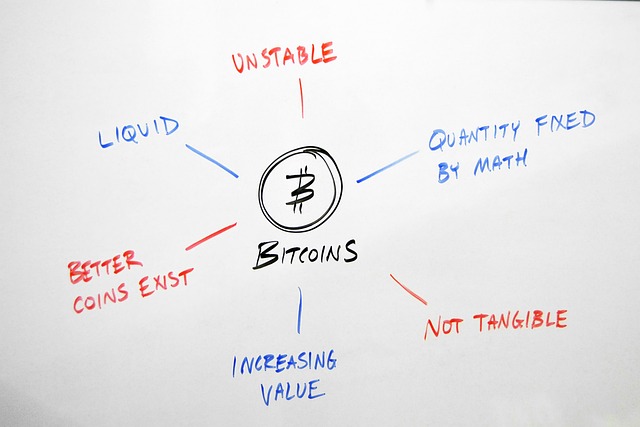

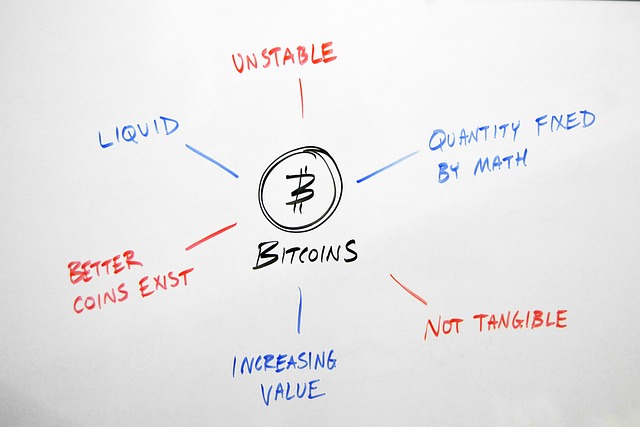

Moreover, digital transactions often rely on complex systems and third-party service providers. Any weakness or breach in these networks could potentially compromise the entire process. Unlike traditional checks, which are tangible and physically handled, digital records are more susceptible to unauthorized modifications, double-spending, and other forms of fraudulent activities. As a result, users must place significant trust in the security measures implemented by financial institutions and technology companies to safeguard their financial transactions.

Cost Comparisons Between Online and Traditional Checks

Online checks offer a convenient and digital alternative to traditional paper checks, but when it comes to cost comparisons, there are notable differences. While setting up an online checking account may have initial fees or monthly maintenance charges, traditional checks generally come with no such hidden costs. The primary expense associated with traditional checks is the purchasing of physical checkbooks, which pales in comparison to the potential overheads of maintaining an online banking system.

One significant drawback of online checks lies in their cost structure—often featuring transaction fees, especially for non-network ATMs or out-of-state banks. These fees can accumulate quickly, especially for frequent users. In contrast, traditional checks, when used responsibly, can be more economical as they avoid these additional charges. However, it’s essential to weigh these costs against the convenience and accessibility that online banking provides.

Time Efficiency: Online vs. Paper Checks

Online checks offer a significant advantage in terms of time efficiency compared to traditional paper checks. The digital process allows for immediate transactions, enabling businesses and individuals to save valuable time. With just a few clicks, funds can be transferred, and receipts are often available instantly, eliminating the need for manual processing and mailing. This swiftness is particularly beneficial for urgent financial matters, such as paying bills or transferring money internationally.

However, one of the drawbacks of online checks is the potential for delays caused by technical issues or banking system downtime. Unlike paper checks, which can be physically transported and processed without relying on technology, online transactions require a stable internet connection and secure systems, which may not always be guaranteed. This vulnerability to technical faults could result in delayed payments, causing inconvenience and potential late fees.

Drawbacks of Online Checks for Businesses

While online checks offer numerous advantages to businesses in terms of efficiency and cost-saving measures, they also come with certain drawbacks. One significant challenge is security and fraud concerns. Online payment systems are attractive targets for cybercriminals, making it crucial for businesses to implement robust security measures to protect sensitive data. Data breaches can lead to financial losses and damaged customer trust.

Additionally, the digital nature of online checks may pose accessibility issues for some customers, especially those in rural areas with limited access to reliable internet connections or older demographics unfamiliar with digital banking. This disparity can exclude certain segments from utilizing online check services, potentially impacting businesses’ customer reach. Furthermore, online checks might lack the personal touch and immediate feedback that traditional checks provide, which could be important for building and maintaining customer relationships.

The Role of Technology in Check Processing

The digital age has significantly transformed traditional check processing with technology playing a pivotal role in both streamlining and introducing new complexities. Online check processing, facilitated by various banking software and digital payment platforms, offers unprecedented convenience for businesses and individuals. Customers can now initiate payments from their devices, eliminating the need for physical checks. This method provides faster clearing times, real-time transaction tracking, and enhanced security through encryption and fraud detection algorithms.

However, despite these advancements, there are drawbacks to online checks. Security breaches and data hacks remain a concern, as digital transactions rely on sensitive financial information shared over networks. Additionally, internet connectivity issues can disrupt the check processing flow, causing delays or failed transactions. The reliance on technology also means that power outages, software glitches, or system upgrades might temporarily disable the ability to process online checks, leaving businesses and individuals without a traditional backup option.