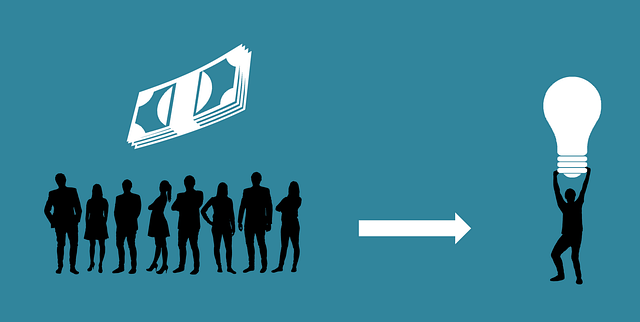

Purchase Order Financing (POF), or Quick Order Finance, empowers businesses to expand without straining cash flow. This method transforms future sales (POs) into immediate capital, enabling companies to fund large orders, settle supplier debts, and manage inventory effectively. By avoiding upfront payments, POF facilitates business growth, streamlines purchasing processes, strengthens supplier relationships, and preserves capital for strategic investments. It's an ideal strategy for funding expansion, quick order finance, and accessing inventory capital in today's competitive landscape.

“In today’s fast-paced business landscape, maintaining cash flow is paramount for success. Purchase order financing offers a strategic solution, enabling companies to access funds without upfront cash outlay. This article delves into the multifaceted benefits of purchase order financing, exploring how it facilitates funding large orders, bridges supplier payments, and unlocks inventory capital for sustainable growth. Additionally, we examine quick order finance as a dynamic tool for fueling expansion and meeting market demand.”

- Understanding Purchase Order Financing and Its Benefits

- How to Fund Large Orders Without Cash Outlay

- Bridging Supplier Payments: A Strategic Approach

- Unlocking Inventory Capital for Business Growth

- Quick Order Finance: Fueling Expansion and Keeping Up with Demand

Understanding Purchase Order Financing and Its Benefits

Purchase Order Financing is a smart solution for businesses aiming to grow and expand their operations without breaking the bank. This innovative financing method allows companies to access capital against future sales orders, enabling them to fund large orders, bridge supplier payments, and gain control over their inventory capital. Essentially, it provides a quick order finance option that supports business expansion by eliminating the need for a substantial upfront cash outlay.

The benefits are clear: businesses can secure the goods or services they need now, knowing they’ll be paid back once the orders are fulfilled. This streamlines the purchasing process, ensures consistent supply chains, and promotes healthy supplier relationships. Moreover, it provides access to inventory capital, allowing companies to invest in stock and equipment without tying up their cash reserves, thereby fostering sustainable growth and flexibility.

How to Fund Large Orders Without Cash Outlay

Funding large orders can be a significant challenge for businesses, especially when cash flow is tight or upfront costs are prohibitive. However, with purchase order financing, entrepreneurs and business owners can access the capital they need to bridge supplier payments and fund their growth ambitions. This innovative approach allows businesses to tap into inventory capital, essentially transforming outstanding purchase orders into immediate funding.

By leveraging purchase order financing benefits, companies can avoid the traditional cash outlay required for large orders. It’s a quick order finance solution that enables business expansion, ensuring entrepreneurs can secure the resources they need without stretching their financial resources to the limit. This strategy is particularly beneficial for those looking to navigate a complex supplier landscape and unlock access to high-quality inventory or raw materials.

Bridging Supplier Payments: A Strategic Approach

Many businesses struggle with upfront cash outlay when it comes to purchasing large orders or expanding their operations. Traditional financing options often require significant collateral and lengthy approval processes, making them less appealing for those needing quick access to funds. However, purchase order financing offers a strategic solution by bridging supplier payments, providing much-needed capital without the usual cash burden.

This approach allows businesses to fund large orders and access inventory capital efficiently, ensuring they can maintain strong relationships with suppliers while keeping operations flowing smoothly. Moreover, it facilitates business expansion funding by enabling companies to take on bigger projects or enter new markets without the financial constraints typically associated with traditional financing methods. In essence, quick order finance through purchase order financing is a game-changer for businesses aiming to grow and thrive in today’s competitive landscape.

Unlocking Inventory Capital for Business Growth

For businesses aiming to expand and grow, Unlocking Inventory Capital is a strategic move that offers numerous advantages. One of the most effective methods to achieve this is through purchase order financing. This innovative solution allows entrepreneurs to tap into their future sales orders as a form of collateral, enabling them to secure funding without any upfront cash outlay. By utilizing funds for large orders and bridging supplier payments, businesses can effectively manage their cash flow and afford the resources needed for growth.

Accessing inventory capital through quick order finance provides several benefits. It offers a flexible funding option, allowing companies to scale operations swiftly. This is particularly valuable in today’s fast-paced business environment where rapid response to market demands is crucial. Moreover, it streamlines the process of acquiring essential materials or goods, ensuring businesses can meet customer expectations and maintain a competitive edge.

Quick Order Finance: Fueling Expansion and Keeping Up with Demand

Purchase Order Financing, often referred to as Quick Order Finance, is a game-changer for businesses looking to fuel expansion and maintain a steady flow of goods without breaking the bank. This innovative funding method allows companies to access inventory capital by financing large orders with suppliers. Instead of tying up cash resources in upfront payments, businesses can secure the necessary funds to bridge supplier payments and fund their business expansion projects.

It offers significant benefits, especially for those navigating a high-demand market. By utilizing purchase order financing, businesses can quickly respond to market fluctuations and customer requests, ensuring they never miss an opportunity due to cash flow constraints. This seamless process empowers companies to focus on what they do best—growing their operations and keeping up with demand.