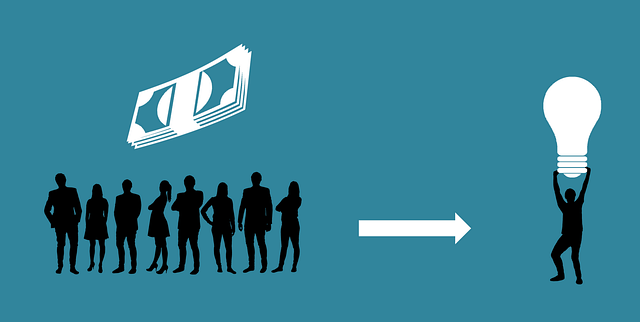

Revenue-linked financing is a game-changer for businesses seeking growth capital without traditional loan or equity drawbacks. This model aligns with revenue goals by providing funding based on future sales potential, with repayment terms structured around achieved revenue milestones. It's ideal for startups and enterprises with high growth potential but limited collateral, offering investors reduced risk and companies access to funds that grow with their success. By incentivizing performance and aligning interests, this approach fosters collaborative growth and sustainable development.

In today’s competitive market, access to growth capital is a critical driver for businesses aiming to scale. Revenue-linked financing emerges as a powerful tool, offering an innovative approach to funding. This article delves into understanding how this financing aligns with revenue, exploring its mechanism, benefits, and strategic applications. By harnessing revenue-linked financing, businesses can secure capital that grows alongside their revenues, fostering sustainable growth and unlocking new opportunities.

- Understanding Revenue-Linked Financing: Unlocking Access to Growth Capital

- How Does It Align with Revenue? A Deeper Look at the Mechanism

- Benefits and Strategies: Harnessing the Power of Revenue-Linked Financing

Understanding Revenue-Linked Financing: Unlocking Access to Growth Capital

Revenue-linked financing is a game-changer for businesses seeking growth capital, offering a strategic approach that aligns with their revenue streams. Unlike traditional loans or equity funding, this innovative model provides access to funds based on the company’s future revenue performance. By securing financing against expected sales, businesses can unlock significant capital without diluting ownership or incurring heavy debt burdens.

This type of financing is particularly appealing for startups and growing enterprises with strong revenue potential but limited collateral. It allows entrepreneurs to harness their future income, enabling them to invest in expansion, product development, or marketing initiatives. With revenue-linked financing, the repayment terms are tied directly to the company’s actual revenue, ensuring a direct correlation between its success and its ability to meet financial obligations.

How Does It Align with Revenue? A Deeper Look at the Mechanism

Revenue-linked financing aligns perfectly with a company’s growth trajectory as it provides capital based on future sales potential. Unlike traditional loans, where repayment is a fixed obligation, revenue-linked financing offers a variable approach. It ties the funding to actual revenue generated, ensuring that both the investor and the business share in the success or challenges of the coming period.

The mechanism involves setting up an agreement where the financier provides capital upfront, which is then repaid (or has its value adjusted) as the targeted revenue milestones are achieved. This aligns with revenue because it incentivizes businesses to focus on growing their sales, knowing that their financing obligations are directly tied to their performance. It also reduces risk for investors since their return is contingent upon the company’s ability to generate revenue.

Benefits and Strategies: Harnessing the Power of Revenue-Linked Financing

Revenue-linked financing offers a unique and powerful approach for businesses seeking growth capital, providing several significant advantages that traditional funding methods may not match. By aligning investments with revenue generation, companies can access funds that grow alongside their success. This strategic financing option encourages sustainable development as investors share in the company’s financial prospects, fostering a collaborative environment. It also reduces the burden of repaying fixed loans, allowing businesses to allocate resources more flexibly for growth and expansion.

Strategies for harnessing revenue-linked financing involve creating structured agreements that link repayment terms to specific revenue milestones. For instance, investors might contribute capital upon signing, with larger amounts released when predefined sales targets are met. This approach incentivizes companies to focus on revenue growth while ensuring investors’ returns are tied to the company’s performance. Additionally, offering equity or convertible securities as part of this financing can attract a diverse investor base, including those who believe in the company’s long-term potential.