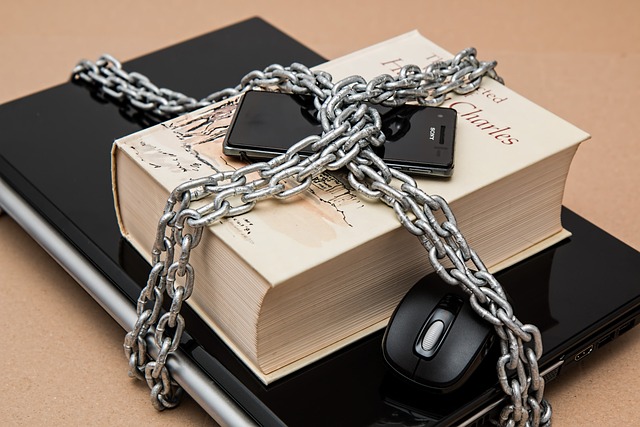

In today's digital era, where personal information is easily accessible, conducting a self background check is crucial for protecting against identity theft and fraud. This involves verifying essential details like social security numbers, addresses, and employment history through documents and credit reports. Online tools streamline this process by instantly confirming identification, financial history, and criminal records, saving time and ensuring data accuracy. Choosing reputable sources ensures robust data privacy and security, safeguarding your personal information.

Conducting a self background check is an essential step to ensure the accuracy of your personal data. In today’s digital age, it’s crucial to verify your information across various platforms and databases. This article guides you through the process, from understanding the importance of accuracy to gathering the necessary documents and utilizing online tools for comprehensive verification. By following these steps, you can proactively maintain the integrity of your personal data.

- Understand the Importance of Accuracy

- Gather Necessary Documents and Information

- Utilize Online Tools for Verification

Understand the Importance of Accuracy

In today’s digital age, where personal information is easily accessible and shared, ensuring the accuracy of your own data is more crucial than ever. A self background check serves as a powerful tool to verify personal details, acting as a safeguard against potential identity theft or fraudulent activities. It allows individuals to take an active role in protecting their privacy and maintaining their digital footprint.

Accuracy in personal data verification is essential for several reasons. Firstly, it helps prevent financial loss and fraud by ensuring that your sensitive information, such as social security numbers, addresses, and employment details, are correctly recorded. Secondly, it empowers individuals to identify any discrepancies or errors early on, allowing them to rectify them promptly. This proactive approach can save time, energy, and potential embarrassment down the line.

Gather Necessary Documents and Information

Conducting a self background check requires gathering essential documents and information to ensure the accuracy of your personal data. Start by collecting all relevant identification documents, such as your birth certificate, driver’s license, or passport. These official records serve as the foundation for verifying your identity and vital statistics. Additionally, gather financial records, including bank statements, tax returns, and investment portfolios. This step is crucial for checking any discrepancies or unusual activities that may indicate potential identity theft or fraud.

Next, obtain your credit reports from the major credit bureaus. Credit reports are a comprehensive record of your financial history, including loans, mortgages, credit cards, and public records. Carefully review these reports to verify the accuracy of your personal information, payment history, and any open or closed accounts. Look for errors, fraudulent activities, or suspicious entries that could impact your financial standing and overall personal data integrity.

Utilize Online Tools for Verification

In today’s digital era, utilizing online tools can significantly aid in conducting a self background check for accuracy. Several websites and applications offer services that allow you to verify personal data such as addresses, employment history, education records, and even criminal records. These platforms often provide instant access to public records, saving you time and effort compared to traditional methods.

When using online tools for verification, it’s crucial to select reputable sources. Cross-referencing information from multiple reliable sites can enhance the accuracy of your findings. Additionally, being mindful of data privacy and security is essential; ensure that the platforms you use have robust measures in place to protect your personal information.