In today's dynamic business landscape, immediate cash access is vital for survival and growth. Invoice factoring and receivables financing provide fast invoice funding, helping SMEs improve cash flow and manage business liquidity. By converting accounts receivable into immediate capital, these methods offer businesses agility to adapt quickly, seize opportunities, and overcome challenges without traditional banking delays. Real-world examples illustrate their effectiveness in enhancing financial health and ensuring prompt access to cash for operations and expansion.

In today’s dynamic business landscape, having quick access to cash for operations is paramount. This article delves into the critical need for businesses to maintain robust cash flow and explores powerful solutions like invoice factoring benefits and receivables financing. We’ll navigate fast invoice funding options, discuss managing business liquidity with efficient strategies, and provide real-world examples of effective cash management. Understanding these tools can revolutionize your business’s financial health.

- Understanding the Need for Quick Access to Cash

- Invoice Factoring Benefits: A Game-Changer for Businesses

- How Receivables Financing Improves Cash Flow

- Navigating Fast Invoice Funding Options

- Managing Business Liquidity with Efficient Strategies

- Real-World Examples of Effective Cash Management

Understanding the Need for Quick Access to Cash

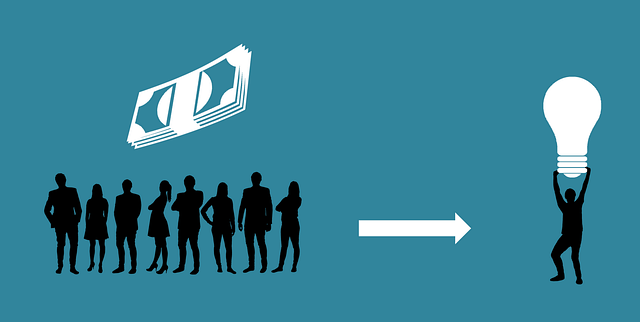

In today’s dynamic business landscape, having quick access to cash is more crucial than ever for operations and growth. Businesses, especially small and medium-sized enterprises (SMEs), often face challenges in managing their cash flow due to delayed payments from clients or fluctuating sales patterns. This can create a liquidity crunch, hindering their ability to cover immediate expenses, seize market opportunities, or invest in expansion plans. Understanding these cash flow constraints is the first step towards implementing effective solutions.

One such solution gaining traction is invoice factoring and receivables financing. These alternative funding methods offer businesses fast invoice funding, allowing them to unlock immediate cash tied up in outstanding invoices. By leveraging the invoice factoring benefits, companies can improve cash flow, manage business liquidity more efficiently, and focus on core operations without the burden of waiting for payments. This quick access to cash enables SMEs to stay competitive, adapt to market changes, and capitalize on opportunities when they arise.

Invoice Factoring Benefits: A Game-Changer for Businesses

Invoice Factoring Benefits: A Game-Changer for Businesses

One of the primary challenges businesses face is managing their cash flow, especially when dealing with receivables. Invoice factoring offers a revolutionary solution to this dilemma by providing fast invoice funding. This financing method allows businesses to transform their accounts receivable into immediate cash, significantly improving their liquidity. By doing so, companies can seamlessly cover operational expenses, seize market opportunities, and maintain steady financial momentum.

The benefits of invoice factoring are numerous. It streamlines the process of accessing capital, eliminating lengthy waiting periods associated with traditional bank loans. This quick access to cash enables businesses to adapt swiftly to changing market conditions, ensuring they have the resources needed to manage ongoing operations effectively. Moreover, it provides an alternative financing option for those who may not qualify for conventional loans, fostering financial inclusivity among businesses of all sizes.

How Receivables Financing Improves Cash Flow

Receivables financing offers a powerful solution for businesses seeking quicker access to cash and improved operational flexibility. By utilizing this innovative approach, companies can transform their outstanding invoices into immediate funds, providing a boost to their cash flow. This process involves selling incoming invoices at a discount to a third-party funder, allowing businesses to receive the money they are owed much faster than traditional methods. The primary benefit lies in its ability to manage business liquidity effectively, ensuring that operations have the financial support needed to thrive.

The advantages of receivables financing extend beyond improved cash flow. It provides businesses with a fast and efficient way to secure funding without the need for collateral or extensive application processes. This immediate injection of capital enables companies to seize opportunities, cover unexpected expenses, or invest in growth strategies. With faster access to funds, businesses can navigate financial challenges more smoothly, maintain a healthy cash reserve, and ultimately, fuel their long-term success.

Navigating Fast Invoice Funding Options

In today’s fast-paced business environment, having quick access to cash is crucial for operations and managing liquidity. Among the various options available, fast invoice funding stands out as a game-changer for many companies. Invoice factoring benefits include immediate capital injection, allowing businesses to improve cash flow and meet short-term financial needs promptly. By leveraging their outstanding invoices, firms can gain quick access to cash without having to wait for traditional banking processes or long-term loans.

This alternative financing method is particularly useful for small and medium-sized enterprises (SMEs) that often struggle with receivables financing due to lengthy approval times and stringent requirements. Fast invoice funding offers a simple, streamlined approach, enabling businesses to manage their cash flow more effectively and focus on growth opportunities rather than financial constraints.

Managing Business Liquidity with Efficient Strategies

Managing business liquidity is a delicate balance that can make or break a company’s success and stability. Efficient strategies are key to ensuring smooth operations and quick access to cash when needed. One effective approach is invoice factoring benefits, which provide fast invoice funding by converting outstanding invoices into immediate capital. This helps improve cash flow, enabling businesses to meet short-term financial obligations promptly.

Additionally, receivables financing offers another powerful tool for managing business liquidity. By leveraging accounts receivable as collateral, companies can secure funding without disrupting their day-to-day operations. These strategies not only offer quick access to cash but also help in building a strong financial foundation, ensuring that businesses remain agile and resilient in an ever-changing market.

Real-World Examples of Effective Cash Management

In today’s fast-paced business landscape, effective cash management is a true game-changer for operations. Let’s explore some real-world examples where innovative strategies like invoice factoring benefits and receivables financing have made a significant impact on companies’ financial health.

Many businesses, especially those in retail or services, struggle with managing peak season demands and unexpected expenses. A leading e-commerce retailer, facing rapid growth and increased inventory costs, implemented a fast invoice funding solution. By converting their outstanding invoices into immediate cash, they improved their cash flow and were able to cover short-term liabilities while investing in expansion plans. Similarly, a healthcare provider utilized invoice factoring benefits to manage its business liquidity. This allowed them to streamline receivables, ensuring quick access to cash for hiring additional staff and purchasing advanced medical equipment. These examples demonstrate how smart cash management strategies can empower businesses to navigate financial challenges and capitalize on growth opportunities.