Invoice Factoring: A Strategic Way to Secure Business Finances.

Invoice factoring offers businesses, especially SMEs, a flexible solution to secure business finances immediately by selling outstanding invoices at a discount. This method provides much-needed cash flow relief, supports growth funding, and manages unexpected expenses while maintaining a healthy cash reserve for daily operations. By selecting a reputable factoring company, businesses gain enhanced credit lines, improved liquidity, transparency, and competitive rates, allowing them to focus on core activities with peace of mind. This alternative financing method is ideal for those seeking swift funding, avoiding stringent bank eligibility criteria, and optimizing financial health through efficient cash flow management.

Looking for a way to stabilize your business finances and boost cash flow? Invoice factoring could be the solution. This powerful financial tool enables businesses to convert outstanding invoices into immediate funding, providing quick access to capital. By understanding how invoice factoring works and choosing a reputable factoring company, you can unlock secure business finances, streamline cash flow management, and support your company’s growth. Dive into this guide to learn more.

- Understanding Invoice Factoring: Unlocking a Powerful Financial Tool

- How Invoice Factoring Can Stabilize Your Business Cash Flow

- The Benefits of Choosing the Right Factoring Company

- Implementing Invoice Factoring for Optimal Business Finances

Understanding Invoice Factoring: Unlocking a Powerful Financial Tool

Invoice factoring is a financial strategy that allows businesses to access cash flow more efficiently by selling their outstanding invoices at a discount. It’s a powerful tool for securing stable business finances, as it provides immediate funding rather than waiting for customers to settle their debts. This method is particularly beneficial for small and medium-sized enterprises (SMEs) looking to manage cash flow, fund growth, or cover unexpected expenses.

By using invoice factoring, businesses can transform their accounts receivable into immediate assets, offering a substantial advantage over traditional financing methods. It’s a flexible solution that can be tailored to meet the unique needs of each business, providing a safety net during periods of slower payment collections and helping to maintain a healthy cash reserve for day-to-day operations and strategic initiatives.

How Invoice Factoring Can Stabilize Your Business Cash Flow

Invoice factoring offers a powerful solution for businesses seeking stable and immediate cash flow, allowing them to maintain a robust financial foundation. By utilizing this financing method, companies can transform their outstanding invoices into immediate cash, providing a steady stream of funds to support operations. This is particularly beneficial for businesses with delayed customer payments or those experiencing seasonal fluctuations in revenue, ensuring they have the capital required to meet current obligations and invest in growth opportunities.

With invoice factoring, businesses gain access to a quick and efficient way to secure business finances without incurring long-term debt or sacrificing ownership of their accounts receivable. This method simplifies cash flow management by offloading the process of collecting payments from clients, allowing companies to focus on their core activities. As a result, businesses can experience enhanced financial stability, enabling them to navigate market challenges and seize new opportunities for expansion and success.

The Benefits of Choosing the Right Factoring Company

Choosing the right factoring company is pivotal for securing stable and robust business finances. A reputable factor offers more than just cash flow relief; they provide access to enhanced credit lines, enabling businesses to capitalize on growth opportunities. With a trusted partner, companies can focus on their core operations while enjoying improved liquidity and reduced financial strain.

The ideal factoring company prioritizes customer satisfaction, offering transparent terms and competitive rates. They streamline the factoring process, ensuring it’s efficient and secure. This means faster funding, fewer paperwork headaches, and peace of mind, allowing businesses to manage cash flow effectively and make strategic decisions with confidence.

Implementing Invoice Factoring for Optimal Business Finances

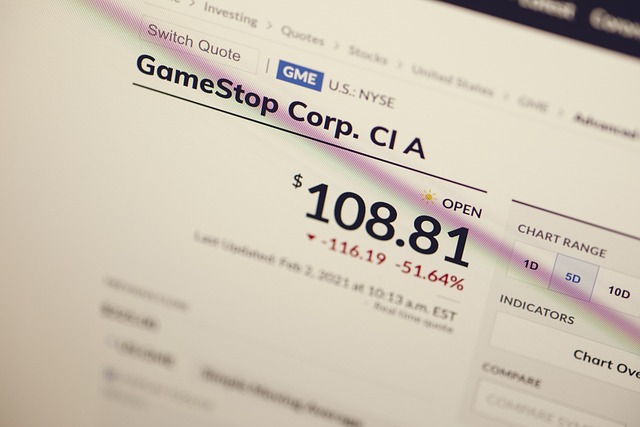

Implementing invoice factoring can be a strategic move for businesses seeking to optimize their financial health and security. This alternative financing method allows companies, especially those with strong sales but cash flow issues, to access immediate funds by selling their outstanding invoices at a discount. By doing so, businesses can significantly enhance their cash flow, enabling them to manage operations more effectively and plan for future growth.

For instance, invoice factoring offers a faster and often more efficient way to secure business finances compared to traditional loans. It provides a flexible solution, allowing companies to avoid the stringent eligibility criteria and lengthy application processes often associated with bank financing. As a result, businesses can focus on what they do best while ensuring their financial stability and peace of mind.