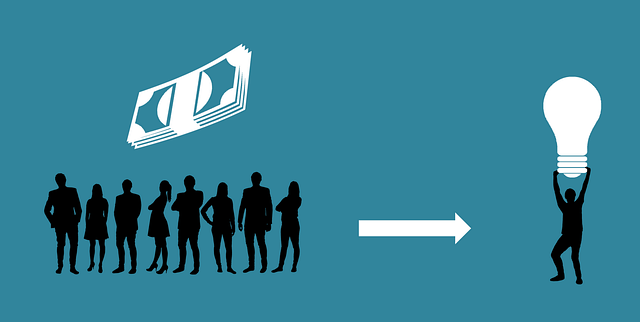

Startups and businesses can accelerate growth by avoiding common funding pitfalls like insufficient planning, reliance on a single investment source, or unrealistic financial projections. Proactive identification of red flags in funding approaches, including personal debt over-reliance and budget discrepancies, prevents long-term financial troubles. Adopting robust financial management systems, regular audits, and clear communication with investors enhances accuracy, informs strategy refinement, and facilitates sustainable growth. Learning from past mistakes is key to successful funding, ensuring optimal resource allocation and informed decision-making for future projects.

Avoiding funding mistakes is crucial for any venture’s long-term success. This comprehensive guide helps you navigate the common pitfalls and identify red flags in your funding strategy. We’ll walk you through correcting errors, providing preventative measures, and highlighting the power of learning from mistakes. By refining your approach, you can continuously improve your funding strategy, ensuring a robust and sustainable future for your project or business.

- Understanding Common Funding Mistakes

- Identifying Red Flags in Your Funding Strategy

- Correcting Errors: Steps to Take

- Preventative Measures for Future Success

- The Power of Learning from Mistakes

- Refining Your Funding Strategy: Continuous Improvement

Understanding Common Funding Mistakes

Many startups and businesses struggle with funding mistakes that can significantly impact their growth trajectory. By understanding these common errors, entrepreneurs can proactively avoid them and improve their overall funding strategy. Identifying funding issues early on is crucial for correcting them effectively and preventing long-term financial troubles.

One of the most prevalent funding mistakes involves insufficient planning and budget allocation. Many businesses fail to conduct thorough market research, leading to overestimations of revenue potential or underestimations of operational costs. This miscalculation can result in unexpected cash flow issues. Additionally, not seeking diverse funding sources is a common pitfall; relying solely on one investment round or loan type increases risk. Learning from these mistakes encourages businesses to develop robust financial forecasts, conduct comprehensive due diligence, and explore various funding options, ensuring a more resilient financial foundation.

Identifying Red Flags in Your Funding Strategy

Many aspiring entrepreneurs and startups fall into common traps when it comes to funding, often realizing too late that their strategies are flawed. Identifying red flags in your funding approach is a proactive step toward avoiding funding mistakes and ensuring long-term success. Pay close attention to any signs that suggest your funding plan may need adjustments. For instance, if you’re relying heavily on personal loans or credit cards for initial capital, it’s a signal that your strategy might be high-risk. These methods can lead to correcting funding mistakes later on, as they often come with high-interest rates and burdensome repayment terms.

Moreover, frequent cash flow issues, despite meticulous budgeting, could indicate problems within your funding strategy improvement. It might be a lack of diversity in funding sources or unrealistic financial projections. By being vigilant and addressing these identifying funding errors early on, you can prevent more significant preventing funding issues down the line, ensuring a smoother journey for your business. Learning from common mistakes is key to refining your approach and fostering a healthier financial foundation.

Correcting Errors: Steps to Take

Identifying and correcting funding mistakes is a crucial step in refining your funding strategy. The first action to take is to thoroughly review all financial records and documents related to past funding attempts or grants. Look for any discrepancies, miscalculations, or errors in reporting. These might include inflated cost estimates, incorrect budget allocations, or missed deadlines that led to unutilized funds. Once identified, these errors should be addressed immediately by rectifying the figures and resubmitting accurate data.

To prevent future funding issues, implement a robust system for tracking and managing financial resources. This involves regular audits, staying up-to-date with relevant regulations and guidelines, and maintaining clear communication with funding sources. By adopting these measures, you can learn from past mistakes and significantly improve your funding strategy, ensuring more successful applications and better utilization of available resources.

Preventative Measures for Future Success

Avoiding funding mistakes is a crucial step for any business or venture aiming for long-term success. The first line of defense against these errors lies in thorough planning and research. Before committing to a funding strategy, take the time to understand your project’s financial needs, explore various funding options, and assess their suitability based on your specific goals. This process involves identifying potential pitfalls that might lead to common funding mistakes like misrepresenting budget requirements or choosing an unsuitable funding source.

To ensure future success, it’s essential to learn from past funding experiences—both successful and unsuccessful ones. Regularly reviewing and updating your funding strategy can help prevent recurring errors. Building a robust system for financial management, including precise tracking of expenses and revenue, enables you to quickly identify any discrepancies or issues. By adopting these preventative measures, businesses can enhance their chances of securing optimal funding, fostering sustainable growth, and steering clear of costly mistakes along the way.

The Power of Learning from Mistakes

Many successful ventures attribute their achievements to learning from past failures and funding mistakes. Identifying and correcting these errors early on is crucial for any business, as it helps prevent significant funding issues in the future. When entrepreneurs recognize a mistake, whether it’s misallocating resources or failing to secure adequate funding, they can use this knowledge to refine their funding strategy.

By studying past errors, founders can develop more robust plans and make informed decisions. This process involves analyzing what went wrong, understanding the root causes, and implementing changes to avoid similar situations. Learning from funding mistakes not only helps in improving individual projects but also contributes to a broader understanding of market dynamics and investor preferences, ultimately leading to better overall funding strategies.

Refining Your Funding Strategy: Continuous Improvement

Refining your funding strategy involves a continuous process of evaluation and adjustment to ensure optimal resource allocation. By regularly reviewing and updating your approach, you can identify potential funding errors early on and correct them promptly. This proactive mindset is key in avoiding costly mistakes and preventing funding issues that may hinder project progress or even lead to delays.

Learning from past funding mistakes is an invaluable lesson. Analyze each project and its financial trajectory to understand what worked well and where adjustments could be made. Identify trends, refine your budgeting techniques, and implement more efficient processes. Continuous improvement in your funding strategy not only helps you avoid repeating errors but also enables better forecasting and decision-making for future endeavors.