Businesses struggle with growth due to operational funding mistakes like misallocating resources and underfunding essentials. These errors, caused by inadequate analysis and planning, can lead to severe cash flow problems. Identifying these issues through audits and industry comparisons is vital for correcting strategies, preventing future problems, and fostering stability. By scrutinizing financial records, taking corrective action, and understanding root causes, organizations can enhance their funding strategy and operational efficiency. Cultivating a culture of financial vigilance with clear budgeting, regular reviews, and stakeholder communication aids in early error detection and continuous strategy improvement, avoiding future hiccups and learning from past mistakes.

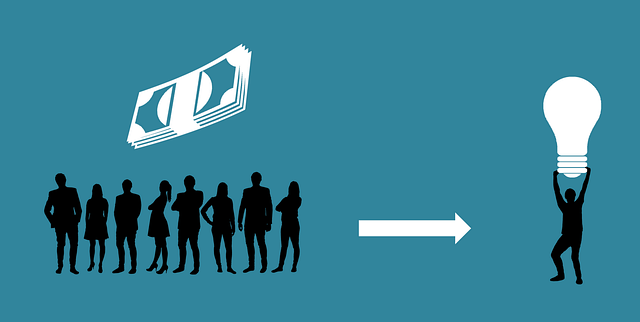

In today’s competitive landscape, recognizing and avoiding funding mistakes in operations is crucial for any business’s growth. This article guides you through understanding common funding pitfalls, such as misaligned budget allocation and inefficient cost management. We outline practical steps to identify and correct funding errors promptly. Additionally, we share strategies to enhance your funding strategy, ensuring a proactive approach to prevent future funding issues. By learning from these mistakes, businesses can improve their financial management and drive sustainable success.

- Recognizing Common Funding Mistakes in Operations

- Steps to Identify and Correct Funded Errors

- Strategies for Preventing Future Funding Issues

Recognizing Common Funding Mistakes in Operations

Many businesses struggle with operational funding mistakes, which can lead to significant losses and hinder growth. The first step in avoiding these issues is learning to recognize common pitfalls. One frequent error is misallocating resources, where funds are directed towards less critical areas while essential operations are underfunded. This often arises from a lack of thorough cost analysis and strategic planning.

Additionally, failing to secure adequate funding for unexpected expenses or market fluctuations can lead to severe cash flow problems. Identifying funding errors early requires regular financial audits and benchmark setting against industry standards. By correcting these mistakes promptly, businesses can improve their funding strategy and prevent future issues, ultimately fostering sustainable growth and stability.

Steps to Identify and Correct Funded Errors

Recognizing and rectifying funding errors is a crucial step in avoiding future operational hiccups. The first step is to identify these mistakes. This involves meticulous scrutiny of financial records, budget allocations, and expenditure patterns. Look for discrepancies between planned and actual spending, unexpected increases or decreases in funding requirements, and any unusual transactions.

Once identified, correcting the errors becomes paramount. This process entails taking immediate action to rectify the issue, whether it’s reallocating funds, adjusting budgets, or implementing new controls to prevent similar mistakes from recurring. It’s also essential to analyze the root cause of the error to understand how it happened and use this knowledge to improve your funding strategy, ultimately enhancing operational efficiency and financial stability.

Strategies for Preventing Future Funding Issues

To prevent future funding issues and avoid making the same mistakes, it’s crucial to implement strategies that foster a culture of financial awareness and precision. Start by establishing clear and detailed budgeting processes. This involves meticulously planning for anticipated expenses, factoring in potential unforeseen circumstances, and regularly reviewing budget allocations. Regularly comparing actual expenses against the initial budget can help identify funding errors early on, allowing for prompt corrective actions.

Additionally, enhancing communication among stakeholders is vital. Ensure everyone involved in financial decision-making understands the organization’s financial goals, constraints, and priorities. Conducting regular funding status meetings can serve as a platform to discuss any discrepancies, learn from mistakes, and refine funding strategies over time. By adopting these proactive measures, organizations can effectively correct funding mistakes, fostering continuous improvement in their funding strategy and overall operational efficiency.