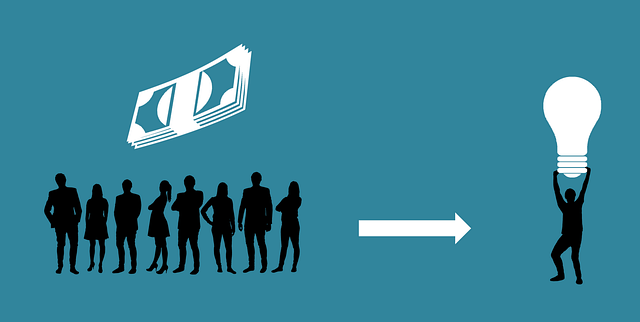

Purchase Order Financing (POF) is a strategic tool that helps businesses unlock growth potential by providing flexible funding for purchasing power. It allows companies to fund significant orders, facilitate supplier payments, and access inventory capital without immediate investment, thereby managing cash flow efficiently. POF benefits include quicker production cycles, better inventory management, and enhanced competitiveness, making it crucial for both large corporations and small-medium enterprises (SMEs) aiming to expand or navigate cash flow challenges. By bridging supplier payments and accessing inventory capital, POF enables businesses to fund growth ambitions without stringent approval processes or extensive credit history requirements.

“Enhance purchasing power and unlock business growth with the power of purchase order financing. In today’s competitive landscape, understanding how this financial instrument can benefit businesses of all sizes is crucial. From funding large orders without cash flow strain to seamlessly bridging supplier payments and accessing inventory capital for strategic growth, purchase order financing offers a game-changer solution. Facilitate business expansion with quick order finance, ensuring smooth operations and fueling your company’s future.”

- Understanding Order Financing and Its Role in Boosting Purchasing Power

- How Purchase Order Financing Benefits Businesses of All Sizes

- Funding Large Orders Without Straining Cash Flow

- Bridging Supplier Payments for Seamless Operations

- Accessing Inventory Capital for Strategic Growth

- Facilitating Business Expansion with Quick Order Finance

Understanding Order Financing and Its Role in Boosting Purchasing Power

Order financing is a powerful tool that enables businesses to unlock their purchasing power and fuel growth. It’s more than just providing funds; it’s a strategic approach to managing cash flow, especially when navigating complex supply chains and ambitious expansion plans. By utilizing purchase order (PO) financing, businesses can fund large orders, bridge supplier payments, and access inventory capital without immediate outlay. This method allows companies to separate the financial burden of purchasing from the actual transaction, creating a flexible funding source for critical business operations.

The role of order financing is pivotal in today’s fast-paced business landscape. It empowers businesses to take on bigger projects, secure exclusive deals, and seize market opportunities without being constrained by cash availability. Quick order finance options ensure that companies can promptly fund POs, accelerating the entire purchasing process. This not only improves operational efficiency but also fosters business expansion, especially for smaller enterprises aiming to establish themselves or scale up.

How Purchase Order Financing Benefits Businesses of All Sizes

Purchase Order Financing Benefits Businesses of All Sizes

For businesses looking to expand or simply manage cash flow, purchase order financing offers a flexible and efficient solution. This innovative funding method allows companies of all sizes to access capital quickly and easily by financing large orders before they’re even placed. Instead of waiting for payments from customers after delivery, businesses can use purchase order financing to bridge supplier payments, ensuring smooth operations and access to inventory capital. This is particularly beneficial during peak seasons or when funding is needed for urgent business expansion projects.

By utilizing quick order finance, companies gain the freedom to focus on their core competencies while leaving financial complexities to specialists. It’s not just large corporations that stand to gain; small and medium-sized enterprises (SMEs) can also leverage purchase order financing benefits to secure orders, manage cash flow effectively, and fuel their growth trajectory. This innovative approach to funding not only supports business operations but also fosters growth by enabling companies to access inventory capital without the traditional constraints of lengthy approval processes or extensive credit history requirements.

Funding Large Orders Without Straining Cash Flow

Funding Large Orders Without Straining Cash Flow

One of the significant challenges businesses face is managing cash flow when dealing with large purchase orders, especially during periods of rapid growth or seasonal peaks. Traditional methods like personal lines of credit or bank loans can be time-consuming and often require collateral. However, order financing offers a more efficient solution. This innovative approach allows businesses to access immediate funds for large orders without disrupting their financial stability. By bridging supplier payments, companies can secure inventory capital, ensuring they have the resources needed to fulfill customer demands promptly.

With purchase order financing, businesses gain the flexibility to fund orders as they come in, preventing cash flow strain. This method not only provides quick order finance but also supports business expansion funding by offering a stable financial foundation for growing operations. By tapping into inventory capital, companies can avoid the constraints of traditional financing and focus on what matters most: expanding their reach and fulfilling customer needs effectively.

Bridging Supplier Payments for Seamless Operations

Bridging Supplier Payments for Seamless Operations

One of the significant challenges businesses face is managing cash flow, especially when dealing with large orders and extensive supply chains. Purchase order financing offers a strategic solution by enabling companies to fund large orders and bridge supplier payments. This innovative approach allows businesses to access inventory capital, ensuring they have the financial flexibility to maintain smooth operations and meet market demands.

By utilizing quick order finance, companies can avoid delays in payment, fostering healthier relationships with suppliers and potentially negotiating better terms. This not only streamlines the ordering process but also opens doors for business expansion funding, as it provides the necessary capital to take on larger projects or expand into new markets without immediate cash constraints.

Accessing Inventory Capital for Strategic Growth

Many businesses struggle with accessing the capital needed for strategic growth, particularly when it comes to funding large orders and expanding their operations. Purchase order financing offers a solution by enabling companies to bridge supplier payments and access inventory capital. This means businesses can secure the goods they need without having to wait for cash flow to catch up, allowing them to take advantage of opportunities as they arise.

By utilizing purchase order financing benefits, such as quick order finance, companies can fund their growth ambitions without incurring long-term debt or sacrificing equity. This strategic approach ensures businesses have the financial flexibility to meet market demands and maintain competitive edge while focusing on core operations and future expansion.

Facilitating Business Expansion with Quick Order Finance

Accessing purchase order financing can significantly facilitate business expansion for companies looking to fund large orders or bridge supplier payments. This type of quick order finance allows businesses to tap into inventory capital, providing them with the necessary funds to acquire goods and services before settlement. For businesses aiming to grow and scale, this is a game-changer as it offers immediate financial support without the need for extensive collateral.

With purchase order financing benefits, companies can embark on ambitious expansion plans, ensuring they have the resources to meet market demands. It streamlines the process of funding large orders by allowing businesses to separate the purchasing power from the payment terms, enabling them to access capital more efficiently. This can lead to quicker production cycles, better inventory management, and ultimately, enhanced competitiveness in today’s dynamic market.